Let’s be honest, the UK economy probably isn’t the first thing on your mind as you sip your morning chai. But here’s the thing: what happens across the pond has ripple effects, even here in India. From impacting global investment flows to influencing the price of that new phone you’ve been eyeing, the UK’s economic health is surprisingly relevant. But, why exactly? That’s what we’re diving into today. Forget dry economic reports. We’re going to break this down like we’re chatting at your favourite cafe.

Why the UK’s Economic Wobbles Should Be on Your Radar

The UK isn’t just some island nation. It’s a major player in the global financial system. Think of it as a central hub. Its economic performance influences investor sentiment worldwide. When the UK experiences economic slowdown , investors often become more risk-averse. This can lead to a decrease in investment in emerging markets, including India. What fascinates me is that it isn’t about the size of the UK Economy, it’s more about the interconnectedness. As per data from the Office for National Statistics , the UK is the 6th largest economy by nominal GDP.

But, it’s not all doom and gloom. A struggling UK economy can also present opportunities. A weaker pound, for instance, can make British goods and services more competitive, potentially boosting exports and creating new trade avenues for Indian businesses. It’s a double-edged sword, and understanding the nuances is key.

Also, one must keep in mind that recent political instability in the UK, including multiple changes in leadership, has added another layer of uncertainty. This has created volatility in financial markets , impacting currency exchange rates and potentially affecting Indian businesses that trade with the UK. The UK’s fiscal policy is a key indicator of overall economic health.

The Brexit Effect: Still Unfolding Years Later

Brexit – remember that? – continues to cast a long shadow over the UK economy. I initially thought the impact would be immediate, but then I realized it’s a slow burn. Leaving the European Union has disrupted trade relationships, created new regulatory hurdles, and contributed to labour shortages. As explained in a recent report , the long-term consequences are still playing out, and they’re not always easy to predict.

For India, Brexit presents both challenges and opportunities. The UK is now free to strike its own trade deals, which could lead to more favourable terms for Indian businesses. However, the increased complexity of trading with the UK and the potential for divergence in regulations could also pose obstacles. Here’s the thing: adaptability is crucial. Indian businesses need to stay informed and be ready to adjust their strategies as the situation evolves.

Inflation and the Cost of Living Crisis: A Global Problem

Inflation is the buzzword on everyone’s lips, not just in the UK, but globally. The rising cost of living is squeezing household budgets and putting pressure on businesses. The Bank of England, like central banks around the world, is trying to tame inflation by raising interest rates. But this can also slow down economic growth. It’s a delicate balancing act.

From an Indian perspective, rising inflation in the UK can have several effects. It can increase the cost of goods imported from the UK, putting upward pressure on prices here. It can also lead to a decrease in demand for Indian exports to the UK, as British consumers tighten their belts. The global nature of supply chain disruptions exacerbates inflationary pressure. As I see it, the path to containing inflation is complex, requiring coordinated efforts across countries.

The Tech Sector: A Bright Spot (But Not Immune)

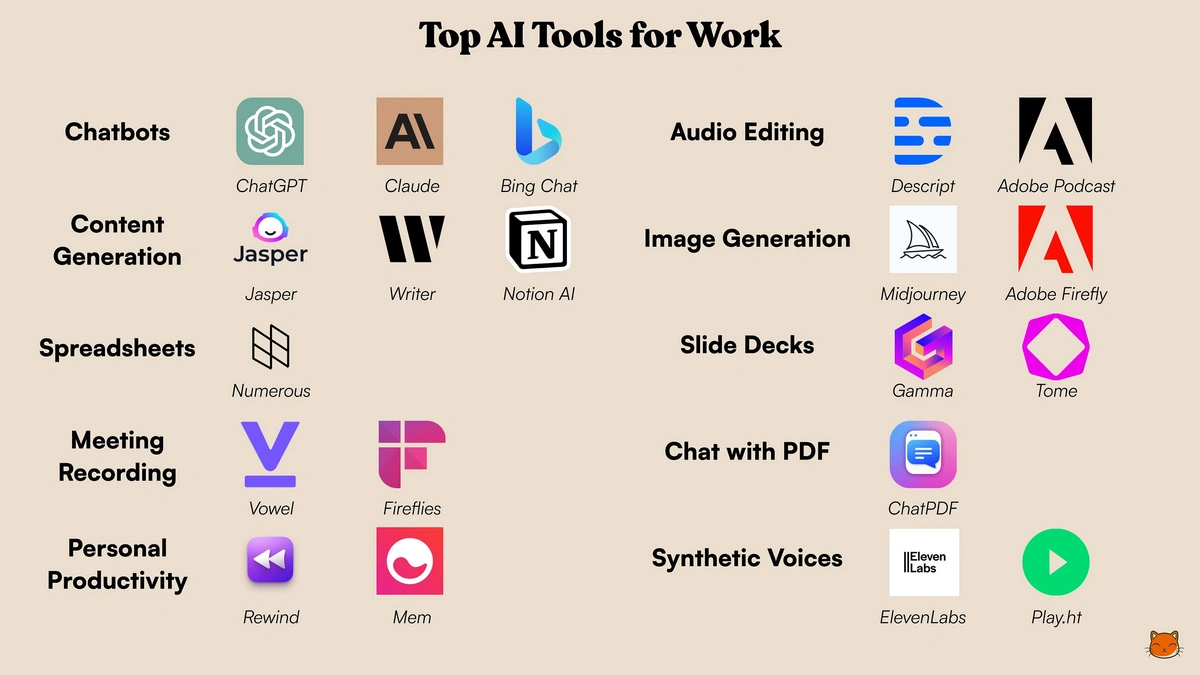

The UK’s tech sector has been a relative bright spot in recent years, attracting investment and creating jobs. But even this sector isn’t immune to the broader economic headwinds. A global slowdown in tech spending and rising interest rates could dampen the sector’s growth. Several indicators like venture capital funding and the pace of new business formations offer insights into the sector’s vitality. Let me rephrase that for clarity: the tech sector’s reliance on investment makes it sensitive to market conditions.

India, with its burgeoning tech industry, has a vested interest in the UK’s tech sector’s success. Collaboration between Indian and British tech companies can drive innovation and create new opportunities. However, Indian tech companies also need to be aware of the risks and diversify their markets to reduce their reliance on the UK.

Navigating the Uncertainty: What Can India Do?

So, what can India do to navigate the uncertainty surrounding the UK economy? The first step is to stay informed. Keep an eye on key economic indicators, policy changes, and market trends. Diversification is also key. Indian businesses should explore new markets and reduce their reliance on the UK. A common mistake I see people make is ignoring diversification because a particular market has performed well in the past.

Furthermore, India can strengthen its own economic resilience by focusing on structural reforms, improving infrastructure, and fostering innovation. A strong domestic economy will be better able to withstand external shocks. The global economic outlook remains uncertain, but by taking proactive steps, India can mitigate the risks and seize the opportunities that arise.

FAQ About the UK Economy and its Impact on India

Why should I care about the UK economy if I live in India?

The UK is a major global financial hub, and its economic performance can affect investment flows, trade, and currency exchange rates, all of which have implications for India.

How does Brexit affect India?

Brexit presents both challenges and opportunities. The UK can now strike its own trade deals, potentially benefiting Indian businesses. However, increased trade complexity and regulatory divergence could also pose obstacles.

What is the biggest threat to the UK economy right now?

High inflation and the rising cost of living are significant threats, putting pressure on households and businesses.

What if the UK enters a recession?

A recession in the UK could lead to decreased demand for Indian exports and reduced investment flows, impacting the Indian economy. However, it might also lead to more competitive trade terms with the UK.

What are the main economic indicators to watch out for?

Key indicators include GDP growth, inflation rates, unemployment figures, and the Bank of England’s monetary policy decisions.

How are interest rates in the UK impacting the Indian economy?

Rising interest rates in the UK can lead to a stronger pound, which can make British goods more expensive for Indian consumers. It also influences investment decisions and global financial stability.

Ultimately, the UK economy’s story isn’t just about numbers; it’s about how interconnected our world has become. The smart move is to understand the forces at play and stay prepared.